The Inflation Reduction Act (IRA) of 2022 has been hailed as a groundbreaking step forward for addressing the climate crisis and advancing clean energy initiatives in the United States. Among its many provisions is the Energy Efficient Home Improvement Credit, a financial incentive designed to encourage homeowners to invest in energy-efficient upgrades.

What is the Energy Efficient Home Improvement Credit?

The Energy Efficient Home Improvement Credit was initially introduced as a $500 lifetime credit for qualifying energy-efficient home improvements. However, the IRA has significantly expanded the program. Starting in 2023, homeowners can claim an annual credit of up to $3,200 for eligible expenses.

The credit equals 30% of the qualified expenses of the following:

- Qualified energy efficiency improvements (e.g., new windows, doors, and insulation).

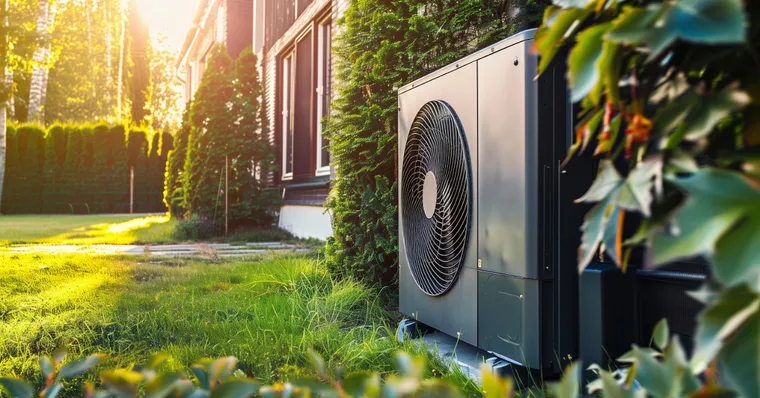

- Residential energy property expenses (e.g., heat pumps and biomass stoves).

- Home energy audits that provide recommendations for improving energy efficiency.

If you work in real estate, this is a great topic to take in a real estate continuing education (CE) course. It’s a smart way to stay updated on how energy-efficient improvements can add value to a home and appeal to buyers.

Key Features of the Credit

Here’s a closer look at what makes the Energy Efficient Home Improvement Credit a valuable opportunity for homeowners:

- Increased Annual Limit

- Homeowners can now claim up to $1,200 annually for improvements like windows, doors, and energy audits.

- An additional $2,000 annually is available for qualified heat pumps, biomass stoves, and boilers.

- No Lifetime Limit

- Unlike the previous lifetime cap, the expanded credit allows homeowners to claim the maximum amount every year they make qualifying improvements through 2033.

- 30% of Qualified Expenses

- The credit equals 30% of qualifying costs, such as materials for insulation, ENERGY STAR®-certified windows and doors, and energy-efficient heating and cooling systems (up to the annual limits described above).

- Eligibility Requirements

- The improvements must be made to the taxpayer’s main home in the United States, and the property must be an existing home rather than new construction.

- Nonrefundable Credit

- The credit is nonrefundable, meaning it can only be used to offset tax liability. Any unused portion cannot be carried forward to future tax years.

Who Qualifies for the Credit?

The credit is designed primarily for homeowners who improve their primary residence. However, it may also apply to:

- Renters making energy-efficient improvements with landlord approval.

- Owners of second homes, although opportunities for second-home credits are limited.

Landlord Exception

Landlords and property owners who do not live in the home are generally not eligible to claim the credit.

Qualifying Improvements

To qualify for the Energy Efficient Home Improvement Credit, improvements must meet specific standards and requirements:

- Windows and Doors

- Exterior windows and skylights must meet ENERGY STAR® Most Efficient certification standards.

- Exterior doors must meet applicable ENERGY STAR® requirements.

- Credit limits: $250 per door ($500 total) and $600 for windows.

- Insulation and Air Sealing Materials

- Must meet International Energy Conservation Code (IECC) standards effective two years prior to installation.

- Heat Pumps, Biomass Stoves, and Boilers

- Systems must have a thermal efficiency rating of at least 75%.

- Credit limit: $2,000 per year, including labor costs for installation.

- Home Energy Audits

- The audit must be conducted on the taxpayer’s primary residence and provide a detailed report of cost-effective improvements.

- Credit limit: $150.

For real estate professionals, adding this topic to the real estate courses you take can help you feel confident about discussing these tax credits with clients and showing how they can make smart home improvement choices.

How to Claim the Credit

Homeowners should file Form 5695 (Residential Energy Credits Part II) with their tax return to claim the Energy Efficient Home Improvement Credit.

Keep these points in mind:

- The credit applies to the tax year when the property is installed, not when it is purchased.

- Proper documentation of expenses, such as receipts and energy audit reports, is essential.

Why Should Homeowners Take Advantage of This Credit?

The Energy Efficient Home Improvement Credit offers multiple benefits:

- Financial Savings

- By reducing taxable income, homeowners can offset the cost of expensive energy-efficient upgrades.

- Increased Home Value

- Energy-efficient homes are highly desirable in today’s real estate market. Buyers are often willing to pay a premium for homes with lower energy costs and modern upgrades.

- Environmental Impact

- Installing energy-efficient systems reduces a home’s carbon footprint, contributing to broader climate goals like achieving net-zero emissions by 2050.

- Ongoing Opportunities

- With no lifetime limit and an annual cap, homeowners can strategically plan upgrades over several years to maximize savings.